Circumstance a rule with different properties or templates

By specializing, or circumstancing, a business rule, you can create conditional variants of the rule that address more specific business cases. These conditions or circumstance options can be a date, property, or template.

Pega 7.2 and earlier versions do not support the circumstancing a rule by a different property when it is already circumstanced by another property. This restriction was intended to prevent conflicts, but made it difficult to address closely related business cases where the same rule needed to be circumstanced by two different properties, date properties, or templates. For example, a section that was circumstanced in a particular framework was required to be circumstanced in another framework with a different property.

In Pega 7.2.1, these restrictions have been relaxed to address business cases that require multiple property circumstancing of a rule. You can:

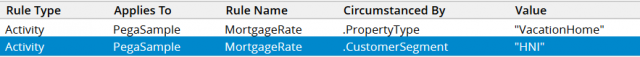

- Circumstance a base rule that is already circumstanced with a different property. Multiple property circumstancing in this way is possible only when the circumstanced rules are in different rulesets or Applies To classes. For example, a MortgageRate rule that is circumstanced by the PropertyType property can be circumstanced again by the CustomerSegment property.

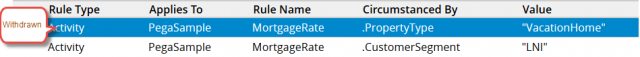

- Circumstance a rule by a different property in the same ruleset by withdrawing the existing circumstanced versions. The circumstanced version in this case must be in the same or higher ruleset version. For example, a MortgageRate rule that was circumstanced by the PropertyType property can be circumstanced again by a different property, CustomerSegment, in the same or a higher ruleset version after the rule MortgageRate(PropertyType) is withdrawn.

The following table summarizes the extended functionality of circumstance options in the latest version.

Version | Specialize by same property in same ruleset or applies to class | Specialize by different property in different ruleset or Applies To class | Specialize by same property in same ruleset or Applies To class after the circumstanced version is withdrawn | Specialize by different property in a higher ruleset version after the circumstanced version is withdrawn | Specialize by different property in the same ruleset version after the circumstanced version is withdrawn | Specialize by a combination of property and template |

|---|---|---|---|---|---|---|

Pega 7.2 and earlier versions | Yes | No | Yes | No | No | No |

7.2.1 - 7.3 | Yes | Yes | Yes | Yes | No | Yes |

| 7.3.1 | Yes | Yes | Yes | Yes | Yes | Yes |

Rule resolution of circumstanced rules

When several circumstanced versions of the base rule are available, the rule resolution algorithm selects a rule based on the availability of rules in the higher ruleset versions as shown in the following table. Depending on whether the conditions in the header row evaluate to true (T) or false (F), the result will be different.

| Circumstanced rule in higher ruleset | Circumstanced rule in lower ruleset | Base rule in higher ruleset | Result |

|---|---|---|---|

| T | T | T | Circumstanced rule in higher ruleset version is resolved. |

| T | F | T | Circumstanced rule in higher ruleset version is resolved. |

| F | T | T | Base rule in higher ruleset version is resolved. |

| F | F | T | Base rule in higher ruleset version is resolved. |

Consider a mortgage bank that uses a MortgageRate collection that calculates the lending rate for all its mortgage products. This base rule belongs to the LendingProducts class and is in the MP: 04-09-08 ruleset.

Assume that this collection returns a rate of 11% for an average customer, based on eligibility criteria such as age, credit score, income, and so on.

MortgageRate (base) = 11.5%

To offer differential pricing for vacation homes, the bank decides to circumstance the base rule by the PropertyType property. The circumstanced rule, MortgageRate(PropertyType), calculates the rate based on the mandatory qualifications and other terms as decided by the organization. This rule is saved in the LendingProductsOther class and in the MP:05-02-07 ruleset.

Assume that this collection returns a rate of 13% for an average customer with a typical profile.

MortgageRate(PropertyType="VacationHome")= 13%

In the near future, the bank responds to a market opportunity to attract high net worth individuals at a lucrative rate to grow its outreach in a consumer segment. It circumstances the base rate by the CustomerSegment propertybased on the usual criteria and competitive discounts, arriving at an attractive rate of 9% for a typical high net worth customer. This rule belongs to the PremiumProducts class and the HP: 03-20-2 ruleset.

MortgageRate(CustomerSegment="HNI")= 9%

A snapshot of the application rule base in an ascending hierarchy can be represented as shown in the following table:

Rule | Circumstance option 1 | Class | Ruleset |

|---|---|---|---|

MortgageRate | NA | LendingProducts | MP: 04-09-08 |

MortgageRate(VacationHome) | VacationHome | LendingProductsOther | MP:05-02-07 |

MortgageRate(CustomerSegment) | CustomerSegment | PremiumProducts | HP: 03-20-2 |

The following scenarios describe rule resolution at run time.

- Scenario 1: When the application encounters different circumstanced versions of the same rule, MortgageRate, it executes the .Mortgage(CustomerSegment) rule because it is in the higher ruleset, resulting in a rate of 9%.

- Scenario 2: When the application encounters different circumstanced versions of the same rule, MortgageRate, and .MortgageRate(CustomerSegment) is unavailable in a lower ruleset, the application executes the base rule, which results in a rate of 11.5%.

- Scenario 3: When the application encounters different circumstanced versions of the same rule, MortgageRate, that are unavailable, the application executes the base rule, .MortgageRate, which results in a rate of 11.5%.